Black Friday: Crystal Ball 🔮

8 trends from last year that will define the 2024 shopping season

In a 2014 Guardian article titled “Surviving Black Friday: A Scientific Guide”, neuroscientist and author Dean Burnett suggests the following tips for Black Friday shoppers:

Stay awake - Sleepy shoppers make bad decisions. Decisions such as the one to sucker punch the guy cutting in line at a Sears.

“Many Black Friday shoppers aren’t functioning at their best, resulting in grumpy moods and irrational decisions.”

Be self-aware - The article cites that Black Friday induces a state of ‘deindividuation’ - a state of reduced self-evaluation where individuals lose self-awareness and adherence to social norms. Mob mentality.

Build upper-body strength - If you’re going to raid the electronics aisle of a Target at 4 AM, you better be able to lug that 55 inch Toshiba around for 37 minutes without using a trolley. (Forget the trolley)

Dress suitably - Reduce the overall friction of your outfit to push through crowds. Outfits made of PVC are known to have a low coefficient of friction and usually do a good job.

Exercise free will - You don’t have to do this. You can shop on literally any other day.

A study from the American Academy of Sleep Medicine (AASM) found that 61% of 18- to 24-year-olds are more tired than usual on Black Friday, compared with the nearly 40% of Americans who report they usually feel more tired than usual on Black Friday.

If you’re looking for a rational buyer (if there even is one), BFCM isn’t the time or place to look for one.

Brands, on the other hand, are a whole different kettle of fish. Brands have the luxury of being rational through the golden quarter mania. A lot of this irrationality begins to vaporize thanks to the law of large numbers - and presents crucial considerations for their BFCM 2024 planning.

This edition is part of a deeper dive into the Black Friday Cyber Monday shopping season. We’ll cover predictions (backed by data) and strategies your marketing team can start with right now to be prepped to pounce before the Halloween outfits hit the stores.

We covered the origins & psychology of BFCM in edition 1.

We continue here: This is our list of 8 key stats every marketer should have in their pocket while prepping for BFCM 2024.

Start early

With a lot of retailers and merchants starting their promotions as early as October, Black Friday is starting to become the less significant protagonist of an extended holiday season play.

Last year, the period from Thanksgiving to Cyber Monday (the Cyber Five) saw web traffic drop 11%, while traffic from November 18 to 22 (the day before Thanksgiving) saw a 41% surge in traffic YoY - 10% higher than the Cyber Five period.

You're missing the boat if you’re not doing an early access sale.

Mobile > Desktop

This is one of those stats that’s going to seem obvious but still seems to evade the collective memory of a lot of brands.

For online transactions, the preference for mobile is growing - and fast. Last year, 54% of all online sales were on mobile devices comprised 54% of online sales - up 10.4% from the previous year.

Take Cyber Week as a whole - and an all-time high 79% of web traffic was on mobile phones, up 3% YoY.

Further up the funnel, 10% of all referrals were from mobile social traffic.

Down the funnel, conversion rates on Black Friday were 6.5% on desktop and 3.2% on mobile, while the average items per order were 3.6 on desktop, 2.9 on smartphone, and 2.9 on tablet.

Buyers want options at check-out (surprise, surprise)

Revenue from Buy Now Pay Later (BNPL) was up 47% in 2023, compared to the previous year, while BNPL online order volume rose by 72% for the week leading up to Black Friday.

Order volume from mobile wallets increased by 54% during Cyber Week, led largely by Apple Pay (54% increase)

Black Friday orders through the installment payment service Klarna rose by 30% in 2023. Klarna says that 8 out of 10 shoppers found the option of paying in installments without extra cost useful.

Options at checkout could do wonders for your conversion rates.

“TikTok made me buy it”

Of all social media traffic, TikTok climbed the highest from the previous year. TikTok's share of traffic to retail sites was up 93% compared to the previous holiday season (Nov & Dec)

Facebook's fell by 4% while Instagram’s share of traffic to retail sites suffered by 8%.

Workforce, meet GenZ.

GenZ, workforce.

Paid search is king

Across all acquisition channels, paid search drove 29.4% of all online sales. Followed by direct visits (19.3), affiliates/partners (16.6%), organic search (15.9%), and email at 15.3%.

Revenue from social media campaigns hovered at less than 5% of total sales this season, but that % grew 5% YoY.

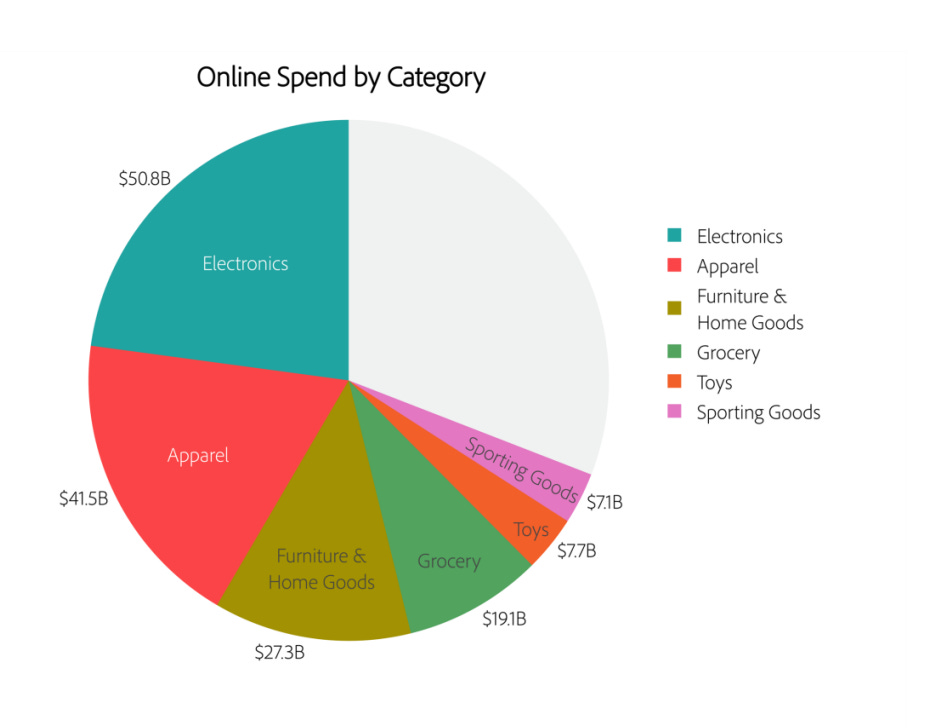

5 categories drive 65% of sales

Of the $222.1 billion spent online this holiday season, over half (65%) was driven by five categories including electronics ($50.8 billion), apparel ($41.5 billion), furniture ($27.3 billion), groceries ($19.1 billion) and toys ($7.7 billion).

Retargeting pays off

Drip reports that winning back previous customers and focusing on your most loyal customers were the big winning strategies in 2023, with total repeat purchases increasing 180% YoY to make up 56% of total purchases in their sample set.

What does that mean for your various marketing channels?

Loyalty and referral campaigns had the highest click-through rates (25.15%) of all campaigns.

E-mail open rates were up 11%, with the average open rate during the BFCM period hovering around the 31% mark.

SMS volume increased 19% in November, with early adopters of the channel cutting through the noise of *checks notes* literally every other channel.

Shopping cart abandonment on Black Friday ranged from 73% to 78%, while revenue generated from abandoned cart campaigns rose by 4.7%

The average cost of a retargeting ad impression can rise 66% during the month. Are you spending your ad dollars on shoppers with intent?

D2C brands use Toplyne to build AI audiences of high-intent shoppers to power their retargeting and prospecting campaigns. Brands see a 35-50% lift in ROAS on Meta & Google campaigns within the 3-week free trial.

Discounts are trending up

"Brain studies have shown that when we are excited by a bargain, this interferes with your ability to clearly judge whether it is actually a good offer or not." - Consumer Psychologist Dr Dimitri Tsivrikos

Discounts make or break a Black Friday sale.

Heavy discounts offered by brands through Cyber Week in 2023 powered buying patterns that continued from Friday until the next Saturday.

The BFCM week saw discount rates climb 27% globally and 29% in the U.S. on average throughout the week. The highest they’ve ever been throughout the holiday season.

In a survey done by Tidio, 62% of people said they preferred a 30% discount code valid only on Black Friday instead of a 15% off gift card to use anytime. (Source)

Strap in for the 2024 festive season

In many ways, we might be in for a Black Swan Black Friday holiday season this year. For more reasons than one:

It’s an election year in the US - brands will compete for ad inventory against political ads in many states.

2024 is likely to be the year GenZ brings social commerce into the mainstream.

We’re in the middle of the AI disruption - in creatives, search ads, and consumer research patterns.

It’s starting earlier than ever. CivicScience predicts that 50% of shoppers will start shopping before Thanksgiving.

Holiday sales in the US alone are expected to reach $1.35 trillion in 2024.

The iron is hot. Who will strike it?

Data sources as promised: